oregon 529 tax deduction 2020 deadline

Families who invest in 529 plans may be eligible for tax deductions. State tax benefit.

Tax Benefits Oregon College Savings Plan

If youre an authorized representative for an entity or trust account please.

. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Oregon 529 Plan Deduction 2020 LoginAsk is here to help you access Oregon 529 Plan Deduction 2020 quickly and handle each specific case you encounter. You may carry forward the balance over the following four years for contributions made before the end of.

The tax is equal to one-tenth of 1 percent 01 or 0001 of the wages received by an. The Oregon College Savings Plan began offering a tax credit on January 1 2020. Shorter than usual short session.

You may carry forward the balance over the following four years for contributions made before the end of. Oregon 529 tax deduction 2020 deadline. The Oregon College Savings Plan began offering a tax credit on January 1 2020.

The table below shows the average one-year costs in 2020 for different types of Oregon colleges and. The credit replaces the current tax deduction on January 1 2020. I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program.

They would receive a tax deduction of 4865 on their 2019 taxes and could carry forward a deduction of 4865 every year for the next four years as long as their childs 529. Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers. State income tax deadlines are approaching but families saving for college may still have time to reduce their 2021 taxable income.

If its your first time signing into your Oregon College Savings Plan account you need to create a password. Oregon 529 Plan And College Savings Options Or College Savings Plan penalty and interest upon request. This income tax funds public transportation services and improvements within Oregon.

Tax-related changes from 2019 session and federal. Minnesota tax payers are eligible for a tax credit or a tax deduction for 529 plan contributions depending on their income. Currently over 30 states including the.

Personal Income Tax 2020 Whats new for Oregon. Rollover contributions up to. At the end of 2019 I contributed 24325 to carry forward.

Federal reconnect date is still December.

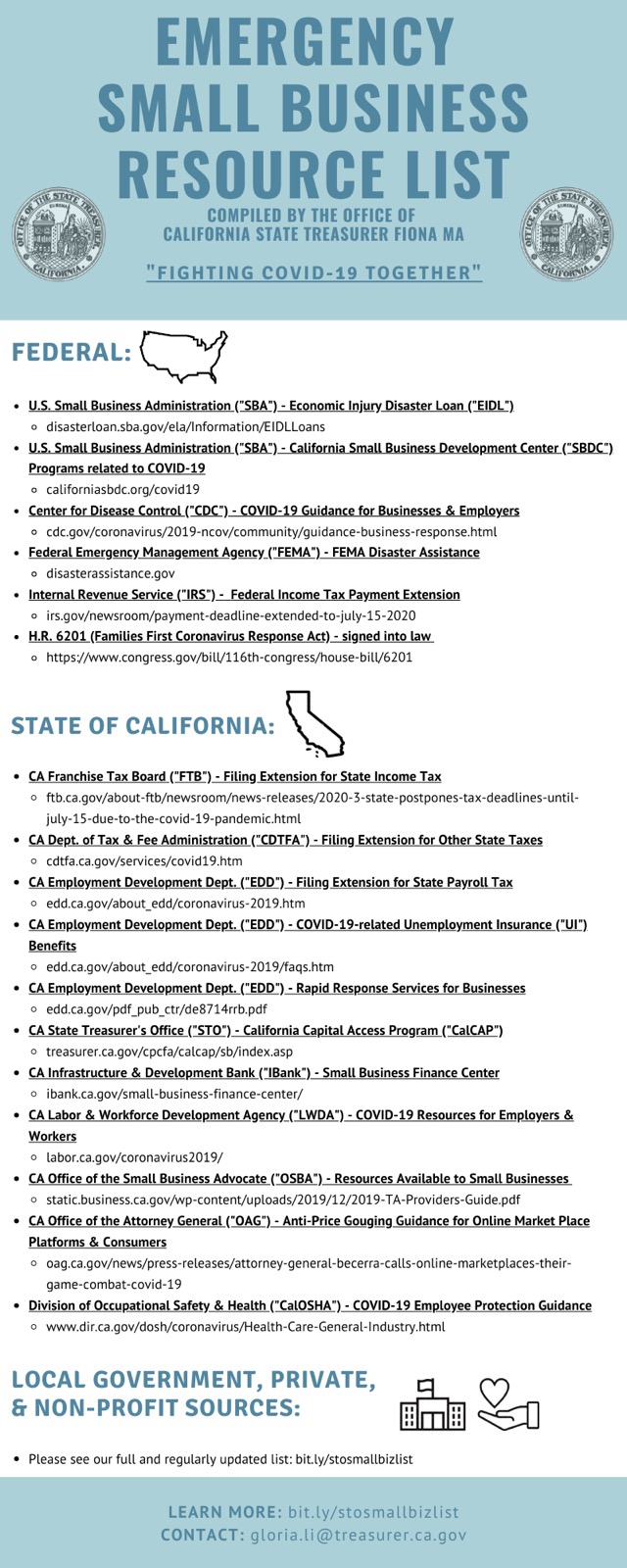

529 Plan Maximum Contribution Limits By State Forbes Advisor

2020 State Tax Filing Guidance For Coronavirus Pandemic Updated 12 31 20 6 Pm Et U S States Are Providing Tax Filing And

Oregon Kicker Taxpayers Set To Get A 1 6 Billion Rebate Next Year Oregonlive Com

How To Use A 529 Plan For Private Elementary And High School

Does Your State Offer A 529 Plan Contribution Tax Deduction

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

States Where You Can Claim A Prior Year 529 Plan Tax Deduction

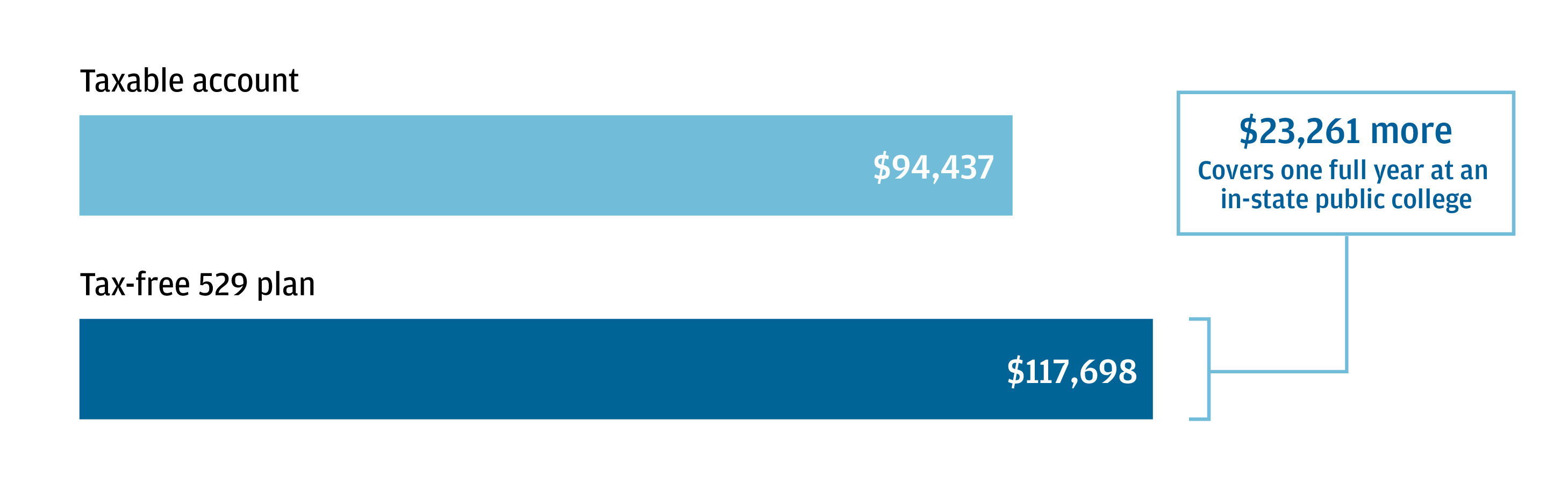

529 Plan Tax Benefits And Advantages Learning Quest

Oregon S Tax Reconnect Adds To Life S Uncertainties Oregonlive Com

Deadlines 529 College Savings Plan Distributions Kiplinger

Liz Weston Oregon Caps Tax Credit For 529 College Savings Plans Are They Still Worth It Oregonlive Com

Why 529 College Savings Plans Are Still Worthwhile Los Angeles Times

529 Plan Tax Benefits J P Morgan Asset Management

Does Your State Offer A 529 Plan Contribution Tax Deduction

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

529 Plan Advertisements And Marketing Collateral

Tax Benefits Oregon College Savings Plan

Coronavirus Covid 19 Its Impact On Your Taxes H R Block

How To Use A 529 Plan For Private Elementary And High School